Keynote

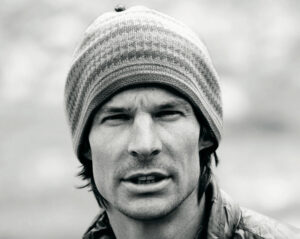

The 2019 Small Business Lending Forum is thrilled to welcome extreme climber, author, and entrepreneur Steve House as its keynote speaker.

Join extreme climber, author, and entrepreneur Steve House as he shares tales—and lessons—from surviving 30 years at the highest level of the world’s most dangerous sport. Managing risk is a business topic attendees are familiar with, but when the risk is to life, do the strategies change? If so, how? And when failure comes, what then?

Join extreme climber, author, and entrepreneur Steve House as he shares tales—and lessons—from surviving 30 years at the highest level of the world’s most dangerous sport. Managing risk is a business topic attendees are familiar with, but when the risk is to life, do the strategies change? If so, how? And when failure comes, what then?

Risk & Reward: Lessons from the World's Greatest Mountains

Steve will take the audience along on his world-record ascent of the biggest, most dangerous mountain wall in the world. Five years on, riding high on a history-making career, and it all came crashing down; 100 feet down. 30 broken bones. Collapsed Lung. A narrow survival.

Rehab and recovery follow, but so do the doubts. What now?

Many of you have climbed your first mountain: Made your own history, captained your own success. But have you asked yourself: What now? What does it mean? If this is all I do in my life, if I were die today, would I be content?

Climbing that second mountain is what Steve does today. Now leading four small businesses, having authored four books, built an instructional video series on the principles of risk, and become a mentor and coach to climbers and athletes worldwide.

This, clearly, is the important work of life. The work that each attendee will find him or herself doing now or in the near future. The work of legacy, building communities, teaching, mentoring, visioning. Sharing lessons learned that are so profound, as you speak them, you surprise even yourself. And you are not alone in this journey. Those that follow Steve’s journey will gain insight into their own.

Schedule of Events

Sunday, July 21

Annual Golf Tournament

10:00am at the Inverness Golf Club

Alternative Event!Rocky Mountain Day Hike

9:00am departure to South Border Peak

Join us for a day of adventure led by keynote speaker Steve House! Boxed lunch and transportation will be provided.

Evening Reception and Dinner

6:00pm on the Aspen Terrace

Monday, July 22

Breakfast

7:30am at the Hilton Denver Inverness Hotel

Sponsored by Frandzel Robins Bloom & Csato, L.C.

Small Business Lending Forum

8:00am at the Hilton Denver Inverness Hotel

The small business lending marketplace is ever-changing. Shifts in legislation, the economic landscape and technology dramatically alter the determining factors of success and profitability for our industry. In the coming years, the competitive advantage will be had by those who prepare for disruption and adapt where necessary.

This year’s forum aims to prepare business leaders for unfavorable lending conditions; help identify hidden opportunity through a focus on diversity within company culture; ready organizations to implement incoming regulatory standards; and highlight the importance of active political advocacy for the small business lending as a whole.

The keynote speaker, extreme climber, author, and entrepreneur Steve House will inspire with tales of triumph and failure from his 30 years performing at the highest level of the world’s most dangerous sport.

Our goal: to provide you with ideas, concepts and an enhanced perspective on how best to optimize your current and future model to maximize capitalization of the small business lending market.

Lunch at 11:30am, sponsored by Lending Science DM

Evening Reception

5:30pm at Top Golf

Don’t forget to join us as we wrap up the 2019 Forum in unforgettable and entertaining fashion with an evening social event at Top Golf! Catered food and drinks will be provided by Mintaka Financial, so join us to say your goodbyes and hit some golf balls under the neon glow!

Forum Agenda

8:30am - 8:45am

Opening Remarks

Dave Schaefer, CEO, Orion First

Mr. Schaefer is the founder and chief executive officer of Orion First and of its subsidiary, Mintaka Financial, LLC. His focus is on growing Orion to become the leading loan and lease servicing company in the United States. He is a strong advocate for capital formation focused on the small and medium business.

With a career spanning forty years in the commercial finance industry, Dave’s leadership experience has been influenced by a broad range of roles including business development, treasury, operations, technology, accounting and portfolio management. He has been involved in both prime and sub-prime markets. Prior to establishing Orion, he was President, and a member of the Board of Directors of Financial Pacific Leasing Company. Dave also founded Checkmate Certified Collections in 1975, a consumer and commercial collection agency.

An active leader and advocate for the industry, Dave is the immediate past chairman of the board of directors for the Equipment Leasing and Finance Association (ELFA). Dave has served on the board of the ELFA since 2009 and became an officer in 2014. He has served as the chairman of LeasePAC, the industry’s federal political action committee and the Small Ticket Business Council. Dave is also on the board of the Innovative Lenders Platform Association (ILPA). The ILPA was formed to advocate for lenders that serve the small business community. He formerly served on the board of directors of the United Association of Equipment Lessors (now the National Equipment Finance Association). He obtained his Certified Leasing and Finance Professional certification in 1996, making him one of the industry’s earliest CLFP’s.

8:45am - 10:00am

Risk & Reward: Lessons from the World's Greatest Mountains

Keynote presented by Steve House

10:30am - 11:30am

CECL: Testing and Implementing the New Current Expected Credit Loss Standard Practices

Lenders and finance companies need to consider how they will adapt to the Current Expected Credit Loss (CECL) Standards. As we near the upcoming implementation deadline, understanding best practices around data gathering, modeling, testing and application are crucial to ensure a smooth transition for all organizations.

Presenters

Shawn Halladay, Managing Director, The Alta Group

Christie Bakker, Partner, RSM US LLP

Zack Marsh, CFO, Mintaka Financial

Erik Cook, Director of Sales – Strategic Accounts, PayNet, Inc.

Town Hall—Orion's Product Roadmap and the Future Ahead

This session will focus on current projects and future plans for Orion and solicit input from the audience on what service enhancements they would like to see and products to consider.

Presenters

Dave Schaefer, CEO, Orion First

Paul Marcoe, CTO, Orion First

Jenny Wood, SVP, Client Services, Orion First

1:15pm - 2:15pm

Preparing for the Downturn

Are you prepared for the next downturn? Many economists project the later part of 2020 for the next recession. This session will focus on experiences from the past recession, lessons learned, best practices, and ways to prepare for the next one.

Moderator

Joe Collins, SVP, Business Development, Orion First

Panel

John Sinodis, Managing Partner, Jennings, Haug & Cunningham, LLP

Jourdan Saegusa, COO, Midland Equipment Finance

Nick Gibbens, VP, Business Development, Wintrust Specialty Finance

Tony Sedlacek, SVP, Portfolio Management, Orion First

What Makes a Company Culture Great?

Successful organizations understand that a key component to success is taking pride in the definition and execution of company core culture across all parts of the business. In times of stress and downturns, culture can often be overshadowed by day to day business and survival. Join us in discussing how leaders in the industry define a successful culture and how they employ others in the company to take pride in ensuring the culture is met at all times.

Moderator

Jenny Wood, SVP, Client Services, Orion First

Panel

Lorie Frasier, SVP, Strategy and Performance Management, Key Equipment Finance

Ken Schneider, SVP, Business Development and Underwriting, Great American Insurance Company

Mike Smith, President, RTR Services, Inc

2:45pm - 3:45pm

Credit Scoring's Place in Underwriting

This session will focus on the role credit scoring plays in the underwriting process, efficiencies it can bring and the balance of scoring and human touch. The use of Orion’s SAIPHTM Score will be discussed.

Moderator

Kim Riggs, Business Development, Orion First

Panel

Barry Ripes, Managing Director, PayNet, Inc

Karen Brown, VP and General Manager, Risk Analytics, Lending Science DM

Bill Fogarty, COO, Mintaka Financial

Reshape or React: Political Advocacy and Small Business Lending

Advocating for small business lending and the equipment finance industry is a responsibility we all share because our efforts fuel the engine of the U.S. economy; small business. Through events like Capitol Connections from the ILPA, ELFA and LeasPAC, we can interact with U.S. Representatives and Senators in Washington, D.C. and legislators and administrators at the state level, to make our collective voice heard.This session will cover current advocacy efforts and the factors influencing the legislative and regulatory landscape, showcasing the need for industry engagement in order to represent the best interests of American small business.

Moderator

Quentin Cote, President, Mintaka Financial

Panel

Andy Alper, Attorney, Frandzel Robins Bloom & Csato, L.C.

Scott Riehl, Vice President, State Government Relations, ELFA

Scott Stewart, CEO, Innovative Lending Platform Association